One of the most confusing aspects of the home purchase, at least for first-timers, is the mortgage process. From the weird terminology used to how it all happens, we frequently meet with dazed stares when we say the “M” word.

The word “mortgage,” by the way, comes from an old French word for “dead pledge.” It was so named because the debt dies when it’s paid off.

We think it’s aptly named because 30 years feels like we’ll be paying on it until we die.

At any rate, the process isn’t as complicated as it seems. Let’s take a look at one aspect of obtaining a mortgage that we receive a lot of questions about: origination fees.

Everybody needs to get paid, right?

There is no getting around it, origination fees “… can add several hundred or thousands of dollars to the total cost of your loan,” according to Angela Brown at FoxBusiness.com.

And, no, the fees that you’ll pay aren’t included in the interest rate.

Enter: origination fees. Thinking of them like the lender’s paycheck for processing your loan takes some of the sting out of paying them. After all, everybody needs to get paid.

Some charge more than others, which is why it’s important to compare the offers from several lenders. We’ll show you how to do that, below.

What’s included in the fees?

What lenders include in origination fees varies, which is why, again, it’s important to take your time shopping for a mortgage.

Some of the more common fees include:

- Processing (what you’ll pay to have your documents examined and the information verified)

- Application fee (a somewhat silly fee you pay just for the “privilege” of applying for a loan)

- Underwriting fee (checking to ensure you qualify)

- Appraisal fee (a charge for reviewing and analyzing the home’s appraisal report)

- Document preparation fee

- Funding

Note, again, that not all lenders charge fees for some of these tasks. In fact, there are loans out today that charge zero origination fees.

The pros at eloan.com, however, offer a warning about these loans:

“These lenders are likely to factor in the cost of the loan process into other areas of the loan, such as the interest rate. When comparing loans, be sure to check whether the origination fee is or isn’t included in the annual percentage rate or APR.”

How much are these fees?

Naturally, the fees vary according to lender and your financial picture. As a rule-of-thumb, “Home buyers typically pay about 0.5% of the amount they are borrowing in origination fees,” according to Hal M. Bundrick, certified financial planner and “… a NerdWallet authority in money matters.”

Aly J. Yale, at credible.com, states a range (0.5% to 1.5% of the loan amount), or “… $1,000 to $3,000 on a $200,000 home loan.”

Many of these fees, by the way, are negotiable.

How to compare lenders’ origination fees

Many real estate consumers don’t understand that a mortgage application is just that: an application. It does not bind you to the lender, legally. The lender will either accept or deny the application and you can then either accept or deny their offer.

Submitting applications to several lenders is not only ok, it’s wise.

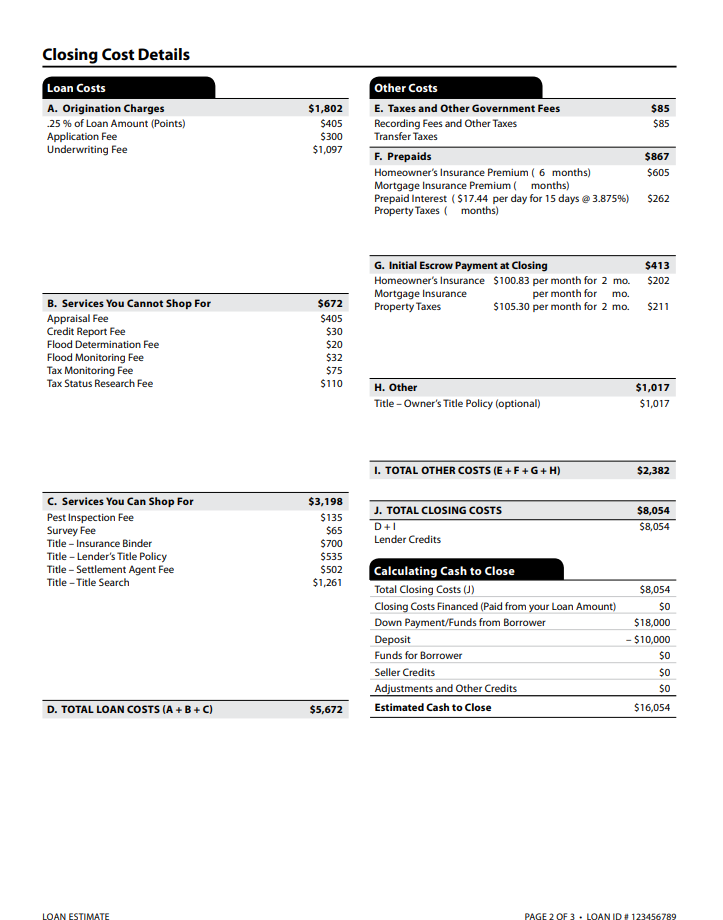

Lenders are required, by law, to supply you with a 3-page form, the Loan Estimate (see image below). This form will supply you with all the information you need to compare lender offerings.

You’ll find the lenders’ origination fees listed on page 2, section A.

“When comparison shopping lenders, the key is identifying the fees that are valid, perhaps even negotiable, and the fees that are tacked onto a loan to pump up a lender’s profit,” also known as “junk fees,” Bundrick suggests.

You are welcome to shop around for some of the fees, as noted on the Consumer Financial Protection Bureau’s sample below.

Another important thing to look for when comparing lenders’ offers is the loan’s annual percentage rate or APR. In fact, this figure is the one to use in your lender comparisons, not the advertised rate.

The latter is what the loan will cost each year. The APR is the advertised rate with the fees tacked on, “… such as mortgage insurance, most closing costs, discount points and loan origination fees,” according to the pros at Bank of America.

Their best advice is to “Compare one loan’s APR against another loan’s APR to get a fair comparison of total cost — and be sure to compare actual interest rates, too.”