A vacation is in order right about now, don’t you agree? And wouldn’t it be amazing to have your own little place, tucked away at the lake, by the sea or in the mountains to get away from the rest of the world and the craziness we’ve been enduring?

If you’re thinking of buying a vacation home, there are a few things you should know and maybe even run by your financial planner.

Can your budget handle two mortgages?

Unless you are fortunate enough to be considered wealthy, making two mortgage payments every month may be challenging.

Before letting the dream of a vacation home carry you away, keep this in mind. Ensure that you can make those two payments and still live comfortably.

PNC Investments senior vice president, Jay Mastilak, suggests that “The basic rule of thumb is that your housing costs – including those for your primary home – should be a third of your overall income.”

Housing costs, as we all know, include more than a mortgage payment. Take a look at the following costs to consider when thinking about buying a vacation home.

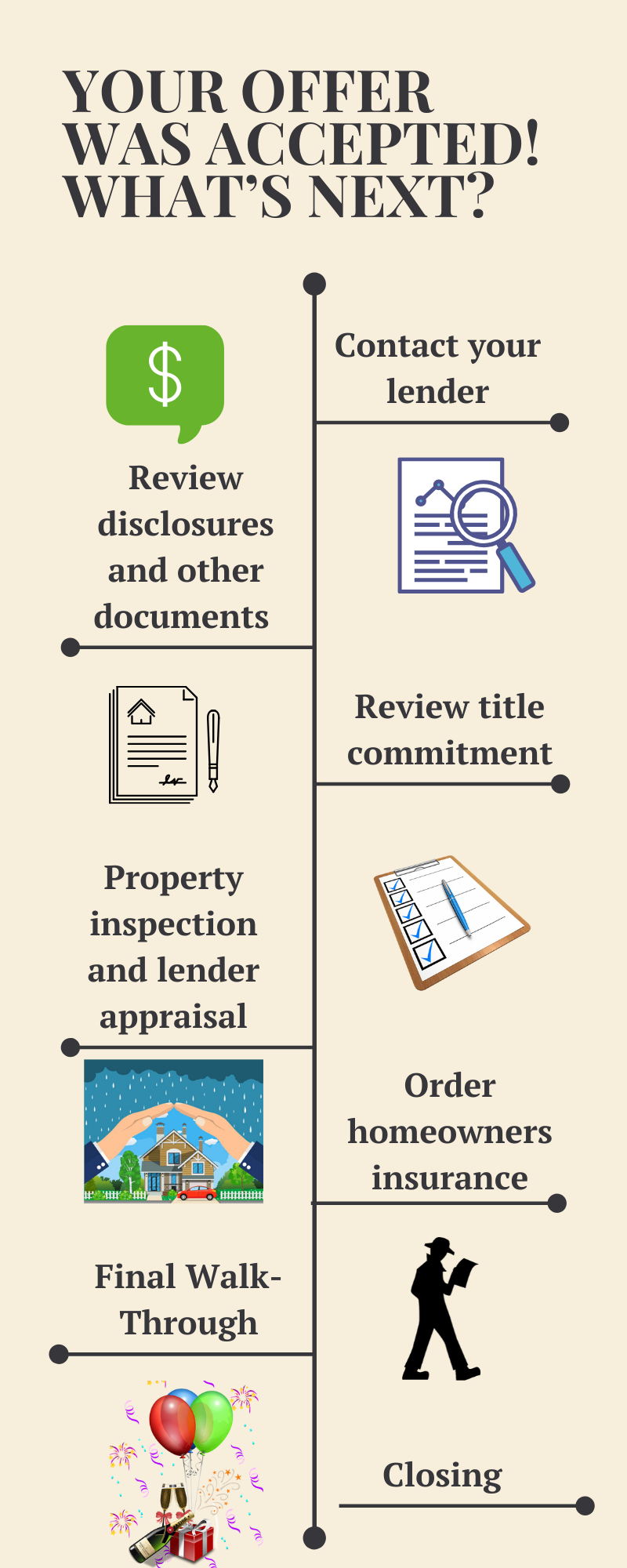

Upfront costs

Remember when you bought your current home? You paid a lot of lender fees, which are probably a blur at this point. Here’s a short list of the most common:

· recording fees

· loan origination fees

· credit report fee

· title insurance premium

· private mortgage insurance

· points

· homeowner’s insurance

· escrow deposits

· miscellaneous fees

Naturally, if you pay cash for your vacation home, you’ll avoid all the aforementioned fees.

Ongoing Expenses

In addition to your mortgage payment, consider these additional ongoing fees:

- Insurance coverage for anything not included in your homeowners insurance. Flood coverage is just one example.

- HOA fees if the home is located in a managed community.

- The cost of maintaining the home

- Utilities

- Security if you won’t be renting out the home in the off-season.

- The cost of travel to the home.

Remember that older homes and those that are larger than normal, will most likely have higher maintenance fees than newer, smaller homes.

Will you rent it out?

One way to help pay for all of this is to rent the home out while you’re not using it.

A part of the rental income may be subject to federal and state income tax, so you’ll want to run this by your accountant before making a decision.

You’ll also want to take into account that the home will experience more wear and tear if it’s lived in for a good portion of the year. And, if you’ll be hiring a management company to help locate tenants and collect the rent, there will be a fee involved for that as well.

Your accountant can help you calculate how long you’ll need to rent out the home to cover the costs of owning it.

“If your monthly mortgage payment is less than or equal to one peak week rental, and you rent approximately 17 weeks per year, you should have break-even cash flow on your vacation home,” according to Christine Hrib Karpinski, author of “How to Rent Vacation Properties by Owner.”

Again, we aren’t accountants or financial professionals, so run this by yours when making the decision as to whether or not you can swing buying a vacation home.