Want to purchase a house that’s not for sale? That’s possible. How to buy a house that is not for sale? Start by identifying the property and tactfully approaching the homeowner, perhaps with a handwritten note. Engage a knowledgeable realtor who will guide you through the offer, negotiation, and legal considerations with expertise. Guarantee to conduct a home inspection and finance your dream home responsibly. With patience, due diligence, and strategic thinking, you can secure your dream home, even if it’s off-market. There’s a lot more to uncover in understanding this process fully, stick around, and you’ll get the complete picture.

Understanding Off-Market Properties

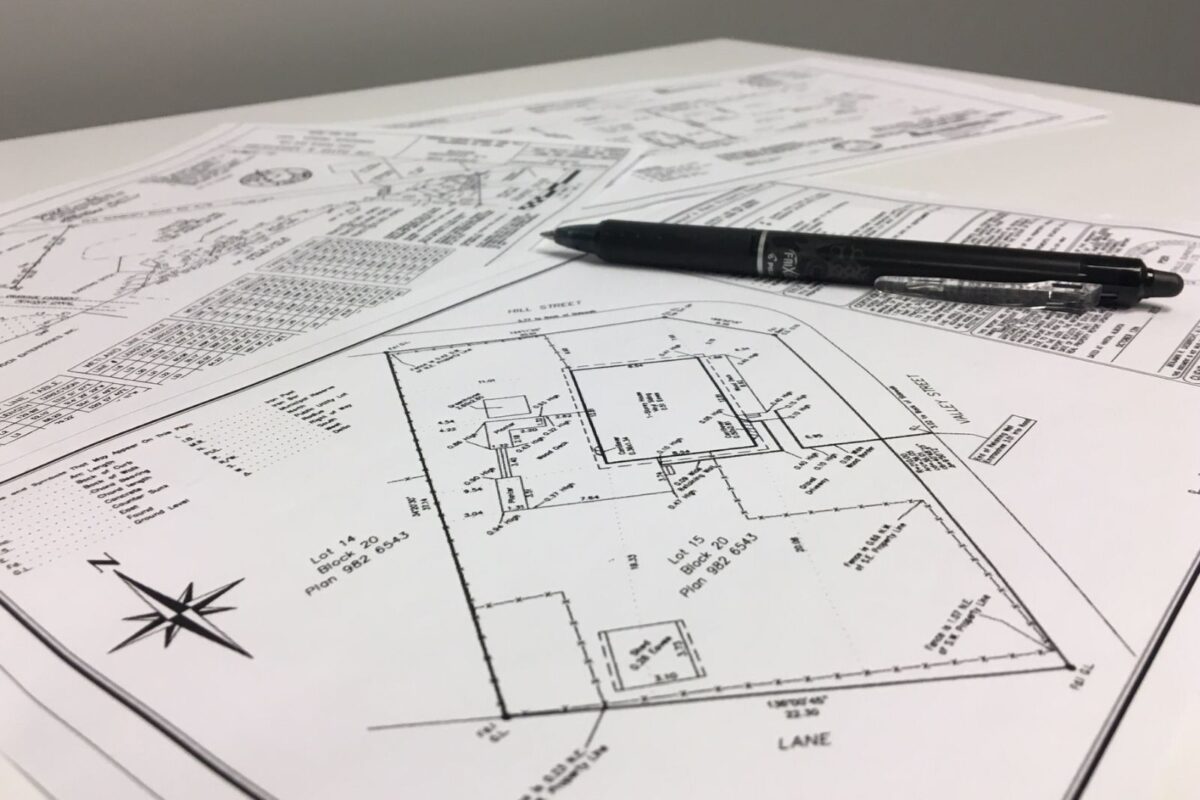

Diving into the world of real estate, it’s crucial for you to understand off-market properties, a potentially lucrative opportunity often overlooked by many buyers. These properties aren’t publicly advertised or listed on the Multiple Listing Service (MLS), giving you less competition and more negotiating power. However, don’t be deceived by the allure of exclusivity. Off-market properties pose certain risks that you need to navigate skillfully. For one, there might be a reason these properties aren’t on the market. They could be plagued with hidden costs like structural issues, code violations, or overdue taxes. These costs can accumulate quickly, turning a seemingly good deal into a financial nightmare. Furthermore, off-market transactions often lack transparency. Without a public listing, it’s more challenging for you to verify the asking price against comparable properties. This lack of visibility can lead to overpaying, especially if you’re not well-versed in property valuation. Having a professional realtor on your side can make all the difference. They can help you navigate these off-market risks and uncover potential hidden costs. Remember, investing in real estate requires more than just capital; it also demands knowledge, vigilance, and strategic thinking.

Researching Potential Properties

Before you can approach a homeowner about purchasing their property, you’ll need to conduct thorough research. This includes:

- Identifying the neighborhood you’re interested in.

- Evaluating the value of properties in that area.

- Finding unlisted properties.

Identifying Desired Neighborhoods

In your pursuit to purchase a house that isn’t currently on the market, pinpointing your preferred neighborhoods becomes an essential step in researching potential properties. You’ll want to contemplate neighborhood amenities such as parks, shopping centers, and public transportation. Accessibility to these conveniences can greatly enhance your lifestyle and the value of your investment. Similarly, school districts play an important role. If you have children, or plan to, top-quality schools are likely a priority. Even if you don’t, houses in good school districts tend to hold their value better. Hence, take time to identify the neighborhoods that meet your criteria. By doing so, you’re not just buying a house, you’re investing in a community.

Evaluating Property Values

Having identified your chosen neighborhoods, it’s crucial to explore the property values in these areas, laying a strong foundation for your house hunting efforts. This includes not only evaluating the renovation costs of potential homes but also understanding the property tax implications that can greatly impact your budget. Analyze local real estate market trends and compare similar properties to gain a realistic view of home prices. Remember, a house’s value isn’t just about the listing price. It’s about the potential costs of making it your home and the ongoing expenses of property tax.

Unlisted Property Discovery

Once you’re armed with a good understanding of property values, your next step should be to find potential properties that aren’t on the market. This is where the art of ‘Property Stalking’ comes into play. It involves stealthily researching and keeping tabs on properties in your desired area that aren’t currently listed for sale. Here’s a simple strategy to start your ‘Stealth Purchasing’ journey:

| Steps | Description |

|---|---|

| 1. | Start by identifying a neighborhood you love. |

| 2. | Look for signs of a potentially available property. |

| 3. | Gather as much information about the property as you can. |

| 4 | Contact the homeowner with a well-structured offer. |

This tactful approach can help you discover hidden gems not visible on the regular market.

Approaching Homeowners Tactically

When you’ve spotted someone buying a house that is not for sale, it’s important to approach the homeowner tactfully to express your interest without causing discomfort or appearing intrusive. Understanding homeowner psychology is key to this process. Many homeowners are attached to their properties and might initially react with surprise or skepticism to unsolicited offers. Your initial contact strategy should be respectful and non-aggressive. It’s often best to send a handwritten note expressing your admiration for the property, and stating your interest in buying it. This method is less invasive than a direct approach. It also gives the homeowner time to contemplate your proposal before responding. Bear in mind that this isn’t a standard transaction, and the typical rules don’t apply. Be prepared to be patient, as the homeowners may need time to digest the idea of selling their home when they hadn’t planned to. Remember, your goal is to make them feel comfortable and in control of the decision-making process.

Crafting a Compelling Offer

Now that you’ve established contact with the homeowner in a respectful and tactful manner, it’s time to focus on crafting an offer that’s compelling enough to motivate them to contemplate selling their beloved property. The key here is to understand the seller’s motivation and use that to your advantage in your offer presentation. First, do your homework. Investigate the property’s value, the local real estate market conditions, and any potential issues with the property. Don’t skimp on this step; information is critical. Next, structure your offer to appeal to the seller’s motivation. If they’re emotionally attached to the home, assure them that you’ll respect and maintain its character. If they’re financially motivated, present a fair offer that benefits both parties and be ready to negotiate. Your offer presentation is vital. It should be professionally structured, clear, and straightforward, outlining your terms and intentions. Remember, details matter. Highlight how you can close fast, save them listing hassle, or offer flexibility in the move-out date.

The Role of Real Estate Agents

As you navigate this complex process, remember that real estate agents play a pivotal role, especially when buying a house that is not officially on the market. Their negotiation skills, market knowledge, and professional relationships can be leveraged to your advantage. Engaging the right agent can make all the difference in securing your dream home.

Agents Negotiation Skills

When dealing with the challenging waters of purchasing a property not on the market, your real estate agent’s bargaining skills become essential to your success. Part of these skills involves mastering persuasion and the art of compromise.

| Negotiation Skill | Why it’s Important | How to Use it |

|---|---|---|

| Mastering Persuasion | Influences seller’s decision | Highlight benefits of selling |

| Art of Compromise | Helps reach a middle ground | Show flexibility in terms |

| Patience | Allows time to contemplate options | Wait for seller to respond |

| Empathy | Understanding seller’s position | Show respect for seller’s feelings |

| Confidence | Shows you’re serious about buying | Stand firm on reasonable offers |

Utilizing Market Knowledge

Understanding the local market intricacies can make or break your dream of acquiring a property not currently for sale, and that’s where your real estate agent’s expertise becomes invaluable. They’re skilled in market trend analysis and real estate forecasting, allowing them to predict potential shifts in the market. This knowledge can help you identify the best opportunities and avoid potential pitfalls. They can guide you on when it’s the right time to approach the homeowner, or if it’s better to wait based on market conditions. Remember, it’s not just about finding the right property but also purchasing it at the right time and price.

Building Professional Relationships

Developing strong professional connections with real estate agents is an essential step in your quest to acquire a house that is not currently on the market. Grasping networking etiquette plays a substantial role in creating and sustaining these bonds. Honor their time, listen carefully, and show appreciation for their expertise. These interactions can result in relationship longevity, an important factor when seeking properties that are not publicly listed.

Legal Considerations and Pitfalls

Traversing the legal landscape can be tricky when purchasing a house that’s not on the market, but awareness of potential pitfalls can save you from costly mistakes. The first aspect to ponder is property ownership disputes. It’s not uncommon for complications to arise, perhaps due to disagreements among family members, or a lack of clarity in wills and trusts. These disputes can be time-consuming and expensive to resolve. Next, let’s examine the significance of title insurance. This safeguards you against any legal issues relating to the property’s title. Without it, you could be liable for any undisclosed liens, illegal deeds, or mistakes in the property’s ownership history. Consider the following risks:

- Unexpected liens or encumbrances on the property

- Fraudulent deeds that could jeopardize your ownership

- Legal action from heirs claiming ownership rights These potential pitfalls underline the importance of thorough due diligence. A professional real estate attorney can guide you through this process, ensuring you’re protected. It’s vital to cover all bases before proceeding with a purchase. After all, what’s the point of buying your dream house if you can’t truly call it your own?

Negotiating With Non-Selling Homeowners

Mastering the art of bargaining with homeowners who aren’t actively selling can throw a curveball in your real estate journey, but with the right approach, you can turn a seemingly impossible task into a successful transaction. Overcoming homeowner resistance is vital. You’ll need to present a compelling case, demonstrating how selling their property can benefit them. Direct communication benefits both parties, it fosters trust and transparency. This open dialogue can lead to a better understanding of the homeowner’s concerns and reservations, which you’ll need to address tactfully. Remember, their home may hold sentimental value, so respect and empathy are essential. When negotiating, don’t rush. Patience can yield better results. Be ready to compromise, but also stand firm on your offer if it’s fair. It’s a delicate balance. Lastly, seek professional advice. Hiring Realtors or real estate attorneys can provide invaluable guidance in these complex negotiations. With their help, you can navigate the process more smoothly, ensuring you don’t infringe on the homeowner’s rights or violate any laws.

Financing Your Dream Home

Once you’ve successfully negotiated with the homeowner, it’s time to figure out how you’re going to finance your dream home. Financing isn’t a one-size-fits-all process. It’s important to explore mortgage alternatives and understand the impact of your credit score on your loan options.

- Traditional mortgages mightn’t always be the best fit for everyone. Exploring mortgage alternatives such as FHA loans, VA loans, or adjustable-rate mortgages can open up possibilities you may not have considered.

- Your credit score has a substantial impact on your loan prospects. A higher score can lead to better interest rates and more loan options.

- Consider the long-term effects of your mortgage choice. It’s not only about securing the property, but also about ensuring you can comfortably meet your financial obligations in the future. Time spent researching and understanding your financing options will pay off in the long run. Consulting with a financial adviser or mortgage broker can provide you with a clear path to securing the best financing option for your situation. Remember, your dream home is within reach with the right strategy and preparation.

Conducting a Home Inspection

An exhaustive home inspection, a crucial step in your home buying journey, can reveal potential issues that might require significant repairs or even deal-breakers that could have you reconsidering the purchase. Don’t underestimate the value of knowing what you’re getting into; it’s worth the inspection costs, which are typically between $300 and $500, depending on the size of the home. This thorough check gives you a heads-up on what might need fixing, from faulty wiring to leaking roofs. It’s not just about being aware of potential repairs; it’s also about finding out if the house is worth your investment, and you don’t buy a house that is not for sale. After all, you wouldn’t want to spend your hard-earned money on a property only to discover it’s a money pit.

Closing the Deal Successfully

Now that you’ve found your perfect home and completed the inspection, it’s time to focus on closing the deal successfully. This process involves three crucial steps: securing the best financing options, negotiating favorable purchase terms, and finalizing the necessary legal agreements. Mastering these steps will guarantee a smooth transaction and get you the keys to your new home.

Securing Financing Options

Before you can successfully close the deal on a house that’s not listed for sale, it’s imperative that you’ve secured your financing options. Understanding your loan eligibility and various mortgage types can be a game changer in achieving this goal. Consider these key points:

- Knowing your credit score and financial health will determine your loan eligibility. A stable income and debt-to-income ratio are critical factors.

- Familiarize yourself with various mortgage types. Whether it’s a conventional, FHA, or VA loan, each has its own benefits and requirements.

- Always explore multiple financing options. Don’t settle on the first lender you meet; shopping around can lead to better interest rates and terms. Having a solid financing strategy can turn your dream of owning a unique, off-market property into a reality.

Negotiating Purchase Terms

Once you’ve secured your financing, it’s time to master the art of negotiation to successfully close the deal on your off-market property purchase. It’s essential to understand potential purchase obstacles and how to overcome them. These could include the homeowner’s emotional attachment to the property, disagreements on the property’s value, or reluctance to sell. Your offer structure plays a pivotal role here. Ensure your offer is both compelling and fair, taking into consideration the market value and the owner’s expectations. Highlight the benefits of your offer when you buy a house that is not for sale, such as convenience, speed, and certainty of the sale. Remember, negotiation is a two-way process. Listen to the owner’s concerns and be prepared to compromise to reach an agreement that suits both parties.

Finalizing Legal Agreements

After successfully guiding negotiations, it’s important to focus on finalizing legal agreements to seal the deal on your off-market property purchase. This stage is pivotal, as it can protect you from potential pitfalls such as:

- Contractual loopholes that could leave you at a disadvantage

- Title disputes that might arise after the purchase

- Potential hidden issues not disclosed during negotiations Engage a proficient attorney to scrutinize the contract for any discrepancies and guarantee a smooth handover of property ownership. Remember, understanding the fine print in your contract can prevent future headaches.

Frequently Asked Questions

What Should I Do if the Homeowner Refuses to Negotiate or Discuss the Sale?

If the homeowner won’t negotiate, you’ll need legal assistance. Understand off-market risks and don’t pressure them. It’s their right to refuse. Remember, other opportunities exist. Be patient, persistent, and always professional in your approach.

How Can I Ensure the Security of My Investment When Buying a House Not Listed for Sale?

Mitigate off-market risks by conducting thorough due diligence. You’ll want to verify the property’s condition, title, and value. Engage a lawyer to guarantee investment protection through a solid purchase agreement. Don’t skip professional inspections.

Are There Any Specific Tax Implications When Purchasing a Non-Listed Property?

Yes, tax strategies and mortgage implications are essential when purchasing a non-listed property. You’ll need to contemplate potential capital gains tax and make sure your mortgage interest deductions are properly handled. Consult a tax professional for advice.

How Can I Deal With a Situation Where Multiple Buyers Are Interested in the Same Off-Market Property?

In off-market competition, you’ve got to be proactive. Maintain the buyer’s etiquette, present a compelling offer promptly, and communicate effectively. Being persistent, yet respectful, can give you an edge over other interested buyers.

What Are the Possible Reasons Why a Homeowner Might Not Want to List Their Property for Sale, and How Can This Impact the Negotiation Process?

Homeowners may not list due to hidden cost considerations or emotional attachment impacts. This can complicate negotiations, as you’ll need to appeal to their personal sentiments and assuage concerns about potential financial burdens.

Conclusion

Securing an off-market property to buy a house that is not for sale may seem challenging, but with thorough research, a strategic approach, and a convincing offer, it’s achievable. Remember, a seasoned realtor can make this process smoother, especially in negotiations and finalizing the deal. Always confirm proper financing and home inspections to avoid future complications. By following this strategy guide, you’re on the right path to owning your dream home, even if it’s not currently on the market. Happy house hunting!