Whether you’re buying a new home, selling an old one, or just looking to make some improvements, you’ve likely heard the term ‘property survey.’ But what is it, and why does it matter?

A property survey is a crucial step in real estate transactions because it can reveal hidden issues, define boundaries, and avoid future disputes. Without one, you’re essentially flying blind, leaving yourself open to potential issues down the line.

Now, wouldn’t you want to avoid that?

Defining Property Survey

So, what exactly is a property survey? A property survey, in essence, is a detailed inspection of a property’s boundaries. It’s a critical tool that gives you a clear picture of what you’re buying, or selling, and what’s included in the deal.

Now, you might be wondering about survey limitations. Well, you’ve got to understand that while a property survey gives you an accurate picture of the property’s boundaries, it doesn’t cover aspects like underground rights or possible zoning changes. It’s not a guarantee of every possible issue, but it’s a strong starting point.

Next, let’s consider the legal implications and what legal papers you should need. If you skip this step and issues arise later, like a dispute over property lines, you could be in for a legal headache. It could lead to costly lawsuits or even the loss of part of your property. In addition, having a survey done can also help you avoid potential fines or legal actions due to zoning violations.

In short, while a property survey has its limitations, it’s a crucial part of any real estate transaction. It provides crucial information and can save you from legal trouble. Don’t underestimate its importance.

Process of Conducting a Property Survey

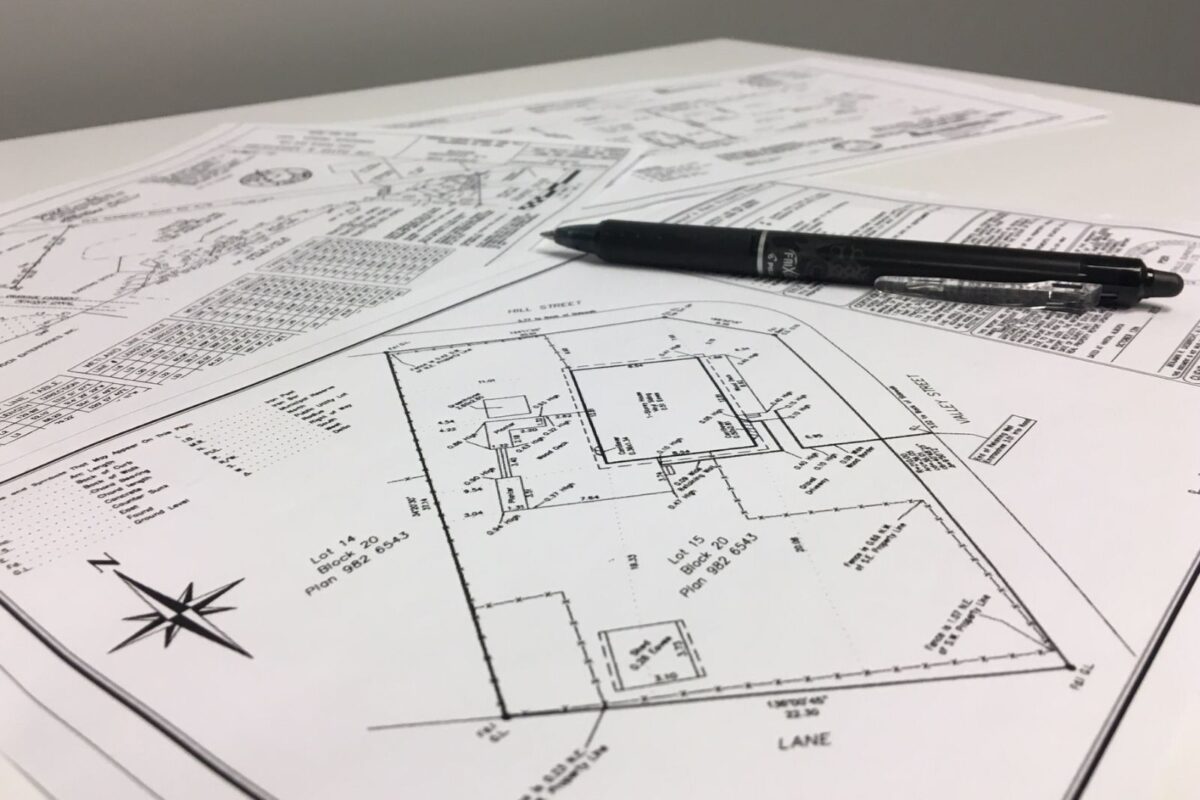

Understanding the importance and role of a property survey, let’s now explore how one is conducted. This process involves several steps and the use of specialized survey equipment.

- Initial Research: You start by researching the history of the property’s boundaries, using old maps and deeds. This gives you a preliminary idea of the property lines.

- Fieldwork: Next, you’ll head to the property with your survey equipment. Advanced tools like GPS devices, total stations, and electronic distance measurement instruments are used to get precise measurements.

- Boundary Disputes Resolution: If there’s a discrepancy between your findings and the existing deed, you’ll need to resolve the boundary dispute. This often involves negotiation between the property owners or legal action if an agreement can’t be reached.

- Report Preparation: Finally, you’ll prepare a detailed report of your findings, including a diagram of the property’s boundaries.

Interpreting a Property Survey Report

Once you receive the property survey report, it’s crucial to know how to interpret the data and diagrams accurately to understand the property’s boundaries and potential issues. You’ll find detailed measurements, markers, and notations that depict the property’s exact layout. But, understanding this information isn’t always straightforward.

You’ll need to first look for any survey inaccuracies. These are mistakes or omissions in the report that can lead to legal disputes or financial losses. For example, a missing easement or incorrect boundary line can dramatically affect property value and usage rights.

Next, focus on report discrepancies. These indicate differences between the survey report and the property’s actual state. A discrepancy could be an unreported structure, like a shed or fence, that encroaches on a neighboring property.

It’s also important to note any encroachments, easements, or right-of-ways. These could limit your ability to modify or use certain parts of the property.

Lastly, make sure to confirm that the physical markers on the property match those in the report. If they don’t, it’s a clear sign of an issue.

In short, interpreting a property survey report requires careful attention to detail. Understanding what to look for can save you from future headaches.

Importance in Real Estate Transactions

While you might view property surveys as just another step in the real estate transaction process, they’re actually a crucial tool that can protect your interests and investment. The importance of these surveys extends beyond mere formalities.

- Survey Costs: These surveys might seem like an extra expense, but they can save you from future financial headaches. They identify potential issues such as boundary disputes or encroachments, which could lead to costly legal battles if not addressed before the transaction.

- Legal Implications: Property surveys provide a legal description of the property, helping you avoid potential legal complications. They’re often required for zoning permits and mortgage loans.

- Knowledge is Power: Surveys can reveal essential information about the property, such as easements, rights of way, or restrictions that could affect your use of the property.

- Negotiation Leverage: If the survey uncovers issues, this can give you leverage in negotiations. You can request that the seller remedy the problems or adjust the price to account for them.

Case Studies: Property Survey Pitfalls

To illustrate the importance of property surveys, let’s delve into a few case studies that highlight the potential pitfalls of skipping this crucial step in real estate transactions.

Case 1: A couple bought a home with a beautiful garden, only to find out later through a property survey that half of the garden belonged to their neighbor. This survey error led to a legal dispute.

Case 2: A developer built a block of apartments, not realizing one corner infringed on a public pathway. A late property survey revealed the error, resulting in costly modifications.

Consider these cases:

| Case | Pitfall |

|---|---|

| Case 3 | A man built a fence on what he thought was his property. A neighbor’s survey showed the fence was on their land, leading to a legal dispute. |

| Case 4 | A woman sold her property, but the survey revealed an old, unregistered right of way through her land, causing the sale to fall through. |

Frequently Asked Questions

What Qualifications Should a Property Surveyor Have?

A property surveyor should have a degree in surveying or a related field, experience, and a professional license. They must adhere to the surveyor’s ethics and fulfill their surveyor’s responsibilities, ensuring accuracy and integrity in their work.

How Long Does It Typically Take to Complete a Property Survey?

Survey timing can vary, but generally, it’ll take a few weeks to complete a property survey. However, unforeseen delays like weather or complex property lines can extend this timeframe. Patience is key.

What Is the Average Cost of a Property Survey?

The average cost of a property survey varies greatly. It’s influenced by factors like survey accuracy and possible pricing discrepancies. You’ll typically spend between $200 and $800, but complex surveys can exceed $1,000.

Can a property owner conduct their own survey?

You can conduct your own property survey, but it’s risky. Without a professional understanding of surveying techniques, you’re likely to make errors. It’s safer and more accurate to hire a professional for this task.

What Should You Do If You Disagree With the Results of a Property Survey?

If you’re unhappy with your property survey’s results, don’t panic. Address survey discrepancies directly with the surveyor. If unresolved, you’ve got legal recourse. Consider hiring an independent surveyor or seeking advice from a real estate attorney.

Conclusion

So, you see, a property survey isn’t just a piece of paperwork. It’s a vital tool in real estate transactions, offering protection and clarity. It helps you understand what you’re really buying, saving you from potential pitfalls down the line.

Never underestimate its importance. After all, it’s better to be safe than sorry, right? So, take that extra step, get that property surveyed, and ensure a smoother, more secure real estate transaction.