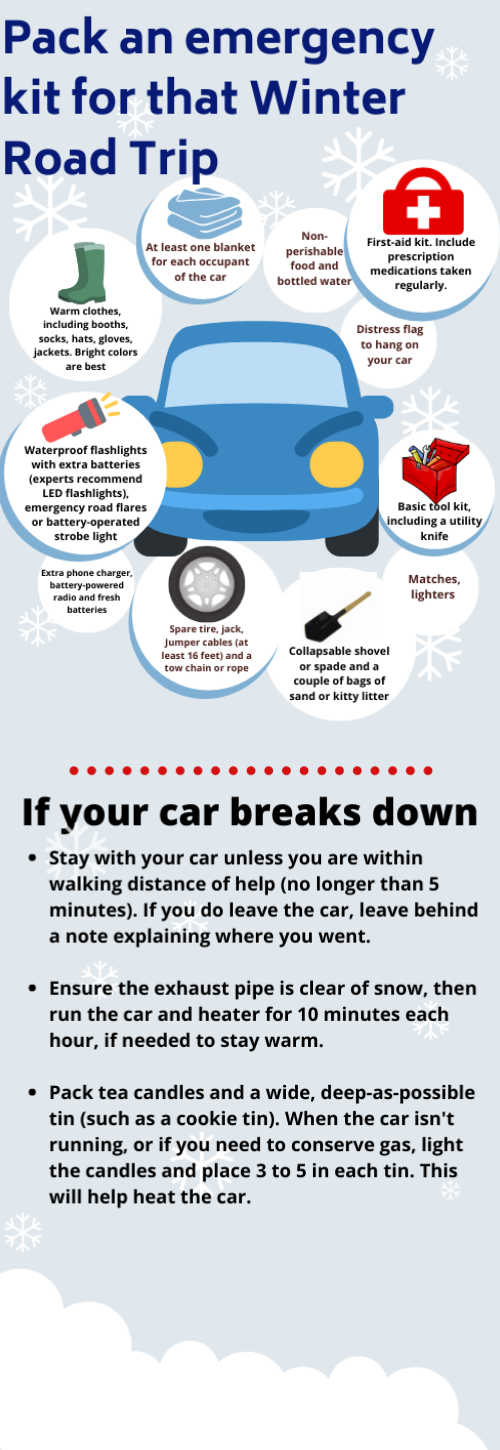

Ready for a winter road trip? Here are a few things you should take along in case of emergency.

Author: Shannon

What to know about fire prevention – Be safe in the kitchen

The pandemic has wrought many changes to life for the average American. More people are gardening, swimming pool installations have skyrocketed, certain household items, such as sanitizing wipes, are still hard to find at the supermarket.

Cooking at home has increased by 54% and, with it, kitchen fires have too. A recent report by the National Fire Protection Association (NFPA) finds that cooking fires are the biggest cause of fires in the homes. They rank second when it comes to fire deaths.

“The leading cause of fires in the kitchen is unattended cooking,” according to the experts with NFPA.

We thought this would be the perfect time to remind you of some basic kitchen and cooking safety tips.

How to avoid kitchen fires and injuries

- Never cook when you are overly tired or intoxicated.

- Nearly 15% of kitchen fire deaths are the result of clothes catching fire while cooking. Avoid wearing long, loose sleeves and reaching into the cupboard above the stove while cooking.

- Remain in the kitchen while you are cooking on medium to high heat.

- Check on slow-cooking food frequently.

- Keep flammable items, such as kitchen towels and hot pads, away from the stove.

- Wipe up spilled food and grease so that it doesn’t catch on fire.

- Keep children and pets away from the stove and never hold a child while cooking. The NFPA suggests creating a “kid-free” zone of at least 3 feet around the stove.

If you have a cooking fire

- Leave the kitchen immediately.

- If there is a door to the kitchen, close it behind you.

- Gather others in the home and move outdoors.

- Dial 911 once you are safe.

- If the fire is in the oven, turn it off and keep the door closed to smother the flames.

- The experts at NFPA suggest that you “Keep a lid nearby when you’re cooking to smother small grease fires. Smother the fire by sliding the lid over the pan and turn off the stovetop. Leave the pan covered until it is completely cooled.”

As we head into the holiday season, keep in mind that most home cooking fires occur at Thanksgiving and Christmas, according to the NFPA survey.

5 Easy to care-for indoor trees

Although houseplants are seeing a resurgence in popularity, especially with our millennial generation, growing plants indoors is an ancient practice.

In fact, it dates back to the early Romans and Greeks, according to Encyclopaedia Britannica. But it was during the Victorian period that we Americans went nuts for growing plants indoors.

Today’s holy grail of indoor growing is the tree. It adds height, texture and drama to indoor décor.

Thankfully, one doesn’t necessarily need a green thumb or a conservatory to be successful with indoor-grown trees. Shopping for those that are easy-growers is the trick.

We’ve rounded up five of the easiest-to-grow indoor trees.

Ponytail Palm

Serious houseplant gardeners know that every home needs a palm. While some are too finicky for the casual grower, anybody can be successful with the ponytail palm (Beaucarnea recurvata or Nolina recurvata).

Ponytail, however, isn’t a true palm, but it’s appearance is close enough to get away with faking it.

Well suited to a more modern interior, the ponytail palm thrives in normal household light levels and won’t up and die on you if the only spot you can find for it offers low light.

This is the ideal plant for the busy indoor gardener because it stores water in its trunk, saving it for those days when you forget or don’t have time to water it. This plant is so water-efficient, in fact, that overwatering it is the most common cause of its demise.

For best results, plant the ponytail palm in a loose potting soil. Cactus mix is ideal. When you water, do so deeply and then don’t water again until the mix is completely dry.

Learn more about the ponytail palm from the master gardeners at the University of Wisconsin-Madison.

Rubber tree

It’s a testament to a plant’s popularity when the likes of Frank Sinatra, Doris Day, Sammy Davis, Jr., Bing Crosby, Dinah Shore and a host of other popular singers put their voices to a song about it.

When you grow the rubber tree plant (Ficus elastica), you may just be singing about it too – it’s that easy to care for.

The rubber tree offers large, shiny, colorful leaves and lots of height (able to grow to 10 feet indoors).

Grow the rubber tree in bright light, although it won’t die if you offer less. In fact, “they grow best with the morning light from an east window,” according to the experts at Clemson University Cooperative Extension.

This is another houseplant that tolerates the forgetful owner, requiring infrequent watering. Learn more about rubber tree care at the aforementioned Clemson University website.

Corn plant

Virtually indestructible, about the only problem encountered by most corn plant (Dracaena fragrans ‘Massangeana’) growers is the brown leaf tips caused by a lack of humidity.

They’re not terribly unsightly and a small price to pay for a practically set-it-and-forget-it houseplant.

The bonus is that corn plant is one of those studied by NASA and found to help clean indoor air of various pollutants.

Don’t overwater the corn plant; it is quite drought-tolerant and may die if overwatered. Allow the soil to dry completely before watering.

Most experts suggest bright indoor light for the corn plant, although personal experience finds that the plant’s leaves fade with too much direct sun and it thrives even in dark corners of the home.

Avoid the brown leaf tips mentioned earlier by placing a humidifier in close proximity to your corn plant.

Learn more about this air-cleaning, statuesque indoor houseplant at the University of Florida IFAS Extension website.

Fiddle Leaf Fig

The current darling of houseplant collectors, the fiddle leaf fig (Ficus lyrata) can grow to 25 feet in the landscape (within its USDA hardiness zones 10B through 11). Find your growing zone at Gardenologist.org.

Most are grown indoors, as houseplants, where they can grow to 6 feet in height. And, by the way, don’t expect to harvest figs from the fiddle leaf – although it hails from the same biological family (Moraceae) as the fig we love to eat, it’s strictly ornamental.

Fiddle leaf thrives in bright but filtered sunlight. It will start leaning toward the sun, so rotate the pot occasionally.

While not as forgiving as some houseplants when it comes to forgetting to water, do allow the top of the soil to dry completely before watering the fiddle leaf fig.

Umbrella Plant

Not only is the umbrella plant (Schefflera arboricola) easy on the eyes, but it’s one of the least-demanding houseplants you can grow.

We must warn you, however, that, if chewed on, the leaves can be harmful to pets and children.

The umbrella plant thrives indoors, where it can grow from 8- to 10-feet in height. Give it bright, filtered sunlight for at least three to four hours per day.

Like most houseplants, the umbrella plant is tropical in nature and requires somewhat warm temperatures. In winter, for instance, temperatures lower than 50 degrees Fahrenheit may cause the foliage to turn black and fall from the plant. Sixty degrees is the umbrella plant’s sweet spot in winter.

When you water the umbrella plant, do so deeply and don’t allow the excess water to sit in the saucer under the plant. Water again when the top ½ inch of soil is dry.

“Schefflera is much more forgiving of too little water, than too much,” according to Dr. Leonard Perry, horticulture professor emeritus with the University of Vermont.

What you need to know about discrimination in mortgage lending

Despite what the media wants us to believe, the U.S. has come a long way since the days of the rampant and blatant discrimination in lending practices we witnessed in the 1930s.

Unfortunately, we still have a rather large patch of ground to cover.

According to a 2016 study published in the Journal of Urban Economics, mortgage loan discrimination often begins well before the acceptance or rejection of a loan application – often during the preliminary stages.

For example, a 2016 study, published in the Journal of Urban Economics, showed that loan officers ignored emailed questions from African Americans 1.8 percent more often than those from white applicants, which is “equivalent to the effect of having a credit score that is 71 points lower.”

The truth is, despite landmark court decisions and studies, there is still discrimination in lending against Americans of color, in some parts of the country.

What is discrimination in lending?

When lenders violate one of two federal laws, the Fair Housing Act or the Equal Credit Opportunity Act (ECOA), they are guilty of discrimination.

The Fair Housing Act lists seven methods of discrimination that are illegal:

- Familial status

- Race

- Color

- Religion

- Gender

- National origin

- Disability

Some Americans are exempt from the law. These include:

- An owner who lives in a building with four units or less.

- Any owner of three or fewer single-family homes who does not use the services of a licensed broker when a property is sold or rented.

- Any dwelling owned or operated by private clubs or organizations to which one must be a member to live there.

The ECOA, on the other hand, is specific to those who offer credit. It forbids discrimination against not only the Fair Housing Acts protected classes but also on the basis of whether an applicant receives public assistance, marital status and age.

Lenders are free to ask you for some of this information, but only under certain circumstances and never are they allowed to ask your religion.

The laws apply to any lender who loans the money to a consumer to purchase, repair, build or improve a dwelling. It also applies to selling, renting, appraising and brokering real property.

The anti-discrimination laws must be applied equally to all mortgage applicants and the lending industry, more than others, is tasked with ensuring that their policies do not exclude or burden those in protected classes, according to the Federal Fair Lending And Credit Practices Manual.

How to protect yourself against mortgage discrimination

Many Americans are confused about their rights and the laws that protect these rights. Discrimination in lending practices, although sometimes blatant, can be evidenced in more subtle ways.

In fact, according to the FDIC, U.S. courts have indicated three types of proof of mortgage discrimination:

- Overt discrimination

- Disparate treatment – Described as “when a lender treats applicants differently based on one of the prohibited factors”

- Disparate impact – “when a lender applies a practice uniformly to all applicants but the practice has a discriminatory effect on a prohibited basis and is not justified by business necessity”

The disparate treatment and disparate impact proofs are so subtle that you’ll need to know the warning signs. The Consumer Financial Protect Bureau has some tips for you:

- The lender tries to discourage you from applying for a mortgage.

- You notice different treatment in person than on the telephone or in emails.

- You are qualified yet the lender rejects your application.

- The lender doesn’t supply you with a reason for rejecting your application.

- You are treated differently in person than on the phone.

- The interest rate you are offered is higher than that for which you originally applied and you are certain you qualify for the lower rate.

Then, shop among several lenders. Not only will this help you find the best rates and terms, but any offer that is blatantly discriminatory will stand out among the others.

What to do if you think you’re a victim of mortgage discrimination

The first step to take if you feel you’ve been discriminated against is to bring it to the attention of the lender, claims Nikitra Bailey of the Center for Responsible Lending, at nerdwallet.com.

Then, start filing complaints. Your state’s attorney general should be notified and you can find out how to do that at naag.org.

Then, file complaints with the Consumer Financial Protection Bureau and with the U.S. Department of Housing and Urban Development.

Sure, it’s easy to take the best lending offer and ignore the lender who is discriminating. By filing a complaint, however, you are helping to protect others from illegal lending practices.

A few things to consider before purchasing waterfront property

If your dream is to live on the water, you’re not alone. Lake or riverfront living is the dream of many and, if you own a boat, it’s understandable that you want to buy a home with a place to keep your “baby.”

Let’s take a look at a few things to consider before shopping for waterfront property.

Do you need to shore up the shoreline?

Erosion is always a concern when water laps against land. Have the homeowners done anything to stabilize the shoreline, such as planting native vegetation, install riprap and retaining walls?

In the “Land of 10,000 Lakes,” the experts at the Minnesota Department of Natural Resources discourage both riprap and retaining walls. They do say, however, that sometimes these installations are necessary.

Will you need flood insurance?

Even if you live in a low-risk area, the pros at the Federal Emergency Management Administration (FEMA) suggest that you carry flood insurance.

“If you live in an area with low or moderate flood risk, you are 5 times more likely to experience flood than a fire in your home over the next 30 years,” they claim.

Because homeowners’ insurance doesn’t cover flood damage, if you live inside or in close proximity to an area with a high risk of flood, purchase flood insurance.

Flood insurance is required by law if you have a federally-regulated mortgage. To find out if you do, go online to MarketWatch.com and scroll to the paragraph that begins with “Now, for the Quiz Answer.”

Some states require those in high-risk areas to carry flood insurance as do most lenders.

To learn the risk of flood damage for your home, enter your address here, at FEMA.gov.

Ensure that your boat type and size is allowed

Most states with waterfront residential property impose restrictions on the types and sizes of watercraft allowed on the lakes and rivers. Check with the Department of Natural Resources (DNR) for restrictions.

Dock considerations

If the home you have your eye on doesn’t have a boat dock and you plan on installing one, you’ll need to determine what’s allowed in the area. What type? How big? These are all questions that either that the DNR and city officials can answer.

Living on the water is a dream for many homebuyers but it’s important to learn all you can about waterfront living before placing an offer to purchase.

Fun Tips for Holiday Road Trips

Whether the holidays take you over the river and through the woods or you travel strictly in the fast lane of a national highway, traveling by car is one of the few things that the pandemic hasn’t changed.

The road trip, whether it’s to Grandmother’s house you go or a fun local getaway with the kids, is one way to get a sense of adventure during the “new normal.”

Since so many Americans spend far more time on the road during the autumn and winter holiday season, we thought it might be time for you to do a checkup on your vehicle. No, not just for safety (that’s a given), but for comfort and convenience as well.

Charge it

The last thing you need on a long road trip is a dead battery in your phone or whatever gizmo is keeping the kids entertained.

About the size of an iPhone, a power inverter can provide DC to AC power. Handy if you need to charge your phone, laptop, “… breast pump, CPAP, nebulizer” and more. We found this one on Amazon.com.

There’s an app for that

Technology is your friend, especially when you’re traveling. Take a look at some of the latest travel apps and download those that meet your needs.

There are plenty of free apps to choose from:

Roadtrippers—If your journey will include multiple stops, this may just be the app for you. Plug in your stops and the app will figure out total trip time and mileage and even offer a guess at how much gas will cost for the trip. It’s available for both iOS and Android.

Waze—Keep abreast of traffic conditions with this app, which actually warns you of traffic conditions ahead. Available for both iOS and Android, the information comes from other users and includes accidents ahead, traffic jams, changes in speed limits and warnings of police in the area.

GasBuddy—Not only will GasBuddy help you locate a gas station (even in the boonies) but will also help you find the one with the least expensive gas prices. In fact, the creators claim that “GasBuddy app users in Canada and the United States have saved over $2.9 billion at the pump over the last 15 years.” GasBuddy is for iOS and Android.

Do a Google search for “travel apps” to find more.

Entertainment

Download stuff to keep the kids busy and yourself from dying of boredom.

- Spotify playlists

- Audiobooks—Check out this list at OpenCulture.com.

- Podcasts—Find information on podcast apps at PodcastInsights.com. For a list of interesting podcasts, check out this list at TheMandagies.com.

Add some small luxuries

- Keep your drinks and snacks cool and within reach with a car-sized cooler.

- Add a “play station” to the backseat for the kids

- Taking turns driving? Catch better Zzzs between shifts. And don’t forget these.

- The kids can get good Zzzs too with an inflatable bed for the backseat. We found two that we like: the Nex Mobile Inflatable Bed and this one, that fills the gap between front and back seat, making the backseat larger.

- Making a night-time pit stop? Download the StarWalk app, point your phone at the sky and learn “…which stars, planets and constellations are above you.” The kids will love this one.

- Get the fast food out of your lap and into something classier. The Zone Tech Car Swivel Tray fits in most cup holders and has a non-skid bottom to keep your food from sliding into your lap.

- Backseat driver has four legs instead of two? Protect the seat with a comfy cover.

While this list is just for fun, don’t neglect all the necessary preparations for a road trip. You’ll find important tips online at The American Red Cross and Triple A.

Still haven’t found your dream home? Consider a fixer-upper

Have you made your wish list of all the things you crave in a new home?

If you have, you may wonder if there’s a home on earth that has all those features, at a price you can afford. Probably not, but in cases like this, it’s time to change the way you shop.

Start looking at ugly homes.

Surprised? Homes that need work, or “fixers” as they are called in the real estate industry, are the ideal choice for the picky homebuyer, and here’s why:

- They are less expensive than homes in move-in condition.

- There is typically less competition in the fixer market.

- You can customize the home to fit your home-buying wish list.

- You may be able to buy in a more expensive neighborhood, which will help boost the home’s value when it’s repaired.

- Financing options are quite attractive.

“In some markets, buying a fixer can really be a game changer, bringing the typical single-family home into reach for a median-income household,” says Realtor.com’s Cicely Wedgeworth.

Shopping for a fixer

Shopping a fixer-upper house for sale may be challenging at first. Remember, these homes are typically not very attractive so you’ll need to learn how to look at them in a different light.

Forget trying to picture yourself living in the home now – picture instead what the home will be like when you’ve transformed it.

The most important aspect of fixer-upper shopping is to find a floor plan that most closely fits your needs without having to knock down too many walls.

While removing a non-load-bearing wall may cost between $2,000 and $3,000, ripping out a load-bearing wall costs $1,200 to $3,000 for a single-story home.

If the home you purchase has more than one story that price jumps to between $3,200 and $10,000, according to the folks at HomeAdvisor.com.

As you can see, the floor plan is key when looking at fixers.

Two professionals you simply must have on your side when shopping in the fixer market include a real estate agent to help you negotiate and a contractor, for obvious reasons.

Financing the fixer-upper

Once you decide on a home, unless you’ll be paying cash for it and for the rehab work you’ll need to get financing. Unlike in years past, today there are several attractive options.

Our favorite programs are the FHA 203(k) loan, the Freddie Mac Home Possible® mortgage and Fannie Mae’s HomeStyle® Renovation Mortgage. Although these programs have different qualification guidelines they all basically offer the same thing: They permit borrowers to wrap the rehab work into the financing for the home.

One loan covers both. With the FHA program you won’t need to start making mortgage payments until you actually move into the home.

This is a significant money and time saver. First, having just one loan means you’ll save on closing costs. With all three programs, the loan amount is typically based on the value of the property when the work is completed.

The process is complicated, we must warn you, but with the right contractor and real estate agent, buying a fixer-upper property may just be the best investment you’ve ever made.

Houseplant rescue

Hot summers and frigid winters are brutal on outdoor plants. We expect that our indoor plants are sheltered from Mom Nature’s extremes so it’s a bit disheartening when that alocasia you’ve fallen in love with gets sick.

There are several common reasons for houseplant problems. Some are caused by improper care, others, such as pests, are not of your doing. Let’s take a look at the causes of some of the most common causes that stress out houseplants.

Improper watering

Those new to growing plants have a tendency to over-nurture them, especially by over-watering. If the plant’s foliage is wilting, check the soil. If it’s dry, water it. If it’s wet, you are either over-watering, or the soil doesn’t drain sufficiently.

Other signs of too much water include:

- Leaves that seem soft

- Inner and lower leaves turning yellow

- Foliage appears scorched (an advanced symptom)

- Leaf drop (another advanced symptom)

Symptoms of the plant not receiving enough water are similar but also include:

- New growth may be smaller than normal

- Wilted foliage

- Folded or misshapen foliage

- Dull, grey-green foliage

- Leaves that appear brittle

There is a fine line between giving a houseplant too much and not enough water and how often to water depends on the environment inside the home.

To determine when to water, stick your finger about an inch deep into the soil. If it is absolutely bone dry, it may be time to water the plant. Take it to the sink and slowly pour water over the soil and keep pouring it until the pot feels heavy and water drains from the bottom of it.

Always allow your houseplants to drain completely before putting the pot back on the bottom tray (if you use one).

When you think it’s finished draining, tilt it at an angle. The chances are good that more water will drip out. This is known as “perched water” and you need to let it drain to keep the roots healthy.

Different plants require different light levels

Most houseplants hail from tropical regions. There, they typically thrive in the rain forest’s under-story, receiving dappled sunlight through the leaves of the tall trees.

Some houseplants, however, thrive in more light and others in less. The easiest way to learn about your plant’s needs is to place it in an area of the home and keep an eye on it for a week or two.

If it seems to be thriving, leave it there. If not, move it into an area that receives either lower or higher light (but not direct sunlight). Keep moving it and, over time, you’ll find the ideal spot for it.

Symptoms of insufficient light include:

- Leaves that curl upward

- New growth that remains small

- The plant is reaching toward the source of light

- Falling leaves

Symptoms of too much light include:

- Scorched leaves

- Leaves that appear to have been bleached

- Limpness

With summer here, it’s only natural that our outdoor plants will become the center of attention. Keep an eye on your houseplants, though, for signs of environmental stress.

First Time Homebuyer Guide

Although the real estate market was sent reeling for a moment under the weight of the pandemic, it didn’t take long for the industry to adapt to a “new normal.”

The housing market is still one of the brightest spots in the U.S. economy and still a wise investment strategy for everyday Americans.

Buying your first home brings with it a plethora of emotions, from excitement to apprehension. Once you understand the process, and realize that there are specific steps to take, it becomes a lot less anxiety-filled and much more exciting.

Let’s take a look at the baby steps that will take you from deciding to purchase a home to the closing table with the least amount of hassle.

How is Your Credit?

Figuring out where you stand financially and applying for a mortgage are the first steps on the road to home ownership. First, think about your credit. If you haven’t checked it in awhile, it’s a good idea to get your reports from the three major credit reporting agencies.

Every U.S. adult is guaranteed one free credit report annually from each of the three major reporting agencies. They are not automatically sent out; you need to request them.

While the internet is full of sites that offer free credit reports, there is often a catch.

“For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period,” warns authorities with the United States Federal Trade Commission.

“If you don’t cancel during the trial period, you may be unwittingly agreeing to let the company start charging fees to your credit card.”

Therefore, they suggest that you use the only company they authorize: AnnualCreditReport.com.

Go over the reports first to look for errors. Take the time to fix any errors before applying for a mortgage.

How are Your Finances?

Knowing where you stand financially is vital to knowing how much you can comfortably spend on house payments every month.

So, step number two involves sitting down with all your bills and determining how much money you bring in and how much goes out every month.

You’ll also need some money set aside for the down payment and closing costs. Some sellers can be persuaded to help with closing costs but it’s not a guarantee you’ll find one, so make sure you have from 2 to 4 percent of the purchase price for closing costs.

Shopping for a Home Loan

Finding a lender willing to lend you the money for a home puts you in a strong negotiating position with home sellers. The lender will let you know how much of a loan you’ll get, at what rate and supply you with a letter of pre-approval.

Shopping for lenders is important so that you can compare rates and terms. And don’t be mislead by the stated loan rate if you’re shopping online. Compare the annual percentage rates (APR) and the fees of each lender.

Lenders will supply you with a loan estimate in a format that is easy to compare with the estimates of other lenders.

NOW you can go home shopping!

Just as soon as you compile your wish list, that is. Write down everything you want in your new home. Of course, you most likely won’t get it all, but it’s important to get clear on what you want.

Go over the list and remove anything you feel is just too unrealistic for your situation. Then, rearrange the list so that the three most important items are at the top.

These three items are your priorities and you should share them with your agent. This way, you’re only shown homes that fit your criteria, saving both your time and ours.

Next, choose a neighborhood. If you’re new to the area we are happy to help you with this step. We have extensive knowledge of all of our local communities, including schools, parks and other amenities.

When you have several neighborhoods in mind, we can go shopping for your new home!

How to Clean Your Ceramic Cooktop

Americans have had a love affair with smooth cooktops since the 1970s when they were first introduced. At that time, the cooktops were created from pyroceramic glass — the same material as Corningware dishes. This material was replaced with less-brittle glass ceramic in the 1990s.

While glass ceramic cooktops lend a sleek, modern silhouette to the kitchen, they have different care requirements than conventional stovetops.

While you won’t need to dig around burners and drip pans, you do need to use caution to avoid scratching the cooktop and you may need to clean it more frequently.

Which cleaning products to use

Avoid using abrasive cleaners and rough scouring pads, which may damage the surface. Products such as bleach, ammonia and oven cleaner may cause discoloring.

The ideal product to use to clean the glass ceramic cooktop is one that is manufactured expressly for that purpose. Read your owner’s manual for a recommendation or consider one of the following products:

How to clean the cooktop

Light stains and spills are easy to clean up if you attend to them as soon as possible.

- Wait until the cooktop is completely cool.

- Pour a few drops of the cleaner onto the surface.

- Use a cleaning pad (included with some of the products) or a clean, soft cloth to wipe the soiled area clean.

To remove heavy stains:

- Use a cooktop scraper (included with some of the aforementioned products) or a metal razorblade scraper, at a 30-degree angle, to lightly scrape the soil from the surface.

- Wipe up the loosened debris.

- Apply a few drops of the cleaner and rub the cooktop with the cleaning pad until it’s clean.

- Buff the surface of the cooktop with a clean microfiber cloth.

Melted plastic, or spills of foods that contain a lot of sugar may require special treatment:

- Don’t wait for the cooktop to cool – these stains require immediate removal.

- Protect your hands with oven mitts.

- Use the scraper or razor blade to scrape the stain from the cooktop.

- Immediately wipe away the loosened debris.

- Allow the cooktop to cool and then clean with the cooktop cleaner and a cleaning pad.